5200 W Market St

Greensboro, NC 27409

336-852-9505

Terry Hough

Terry Hough

President

|

Income Tax Service

5200 W Market St Greensboro, NC 27409 336-852-9505 |

Terry Hough

Terry Hough

President |

This is just a summary of the proposals, without comment. The plan released by the President is a one page plan, so most other details are not available beyond this summary.

Corporations would no longer be taxed on a worldwide system, but would be taxed on a territorial system, and a one-time repatriation tax would apply on the foreign earnings of US companies.

The proposal does not include a provision allowing expensing of all business assets, as originally discussed.

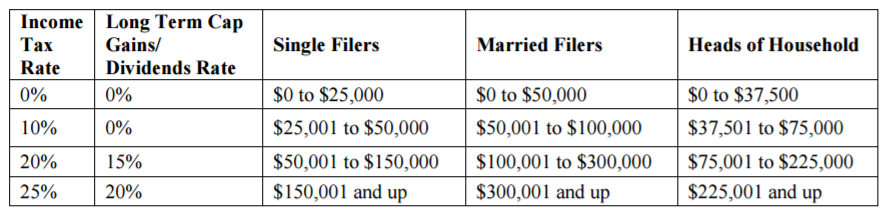

With the new standard deduction and changed brackets, individual taxpayers with taxable income less than $25,000 and married taxpayers with taxable income less than $50,000 would owe no Federal income tax.

Most individual itemized deductions would be repealed, but the deduction for mortgage interest and charitable donations would be retained.