5200 W Market St

Greensboro, NC 27409

336-852-9505

Terry Hough

Terry Hough

President

|

Income Tax Service

5200 W Market St Greensboro, NC 27409 336-852-9505 |

Terry Hough

Terry Hough

President |

They're also a major drag to building wealth...

For example, take the median federal tax burden. It's about 11%. That means for every dollar you make, you keep only $0.89.

What if every American could keep that 11% and combine it with a personal savings rate of just 4%? They'd be saving 15% a year.

And for those with above-median income, your taxes get much higher than 11%.

Plus, even after you pay income taxes... state sales taxes... property taxes... and add to your savings... you still have to pay additional taxes on your investments. Capital gains, interest, and dividends all create taxable events.

But there's an easy way to avoid these onerous taxes.

All you have to do to grab back that extra money is take full advantage of government laws that allow you to set aside pre-tax income in vehicles like IRAs and 401(k)s.

A little-read IRS booklet, Publication 590-A, details how an IRA lets you park the cash and compound your wealth, tax free.

From that point on, you won't have to pay taxes on capital gains, dividends, or interest income for any stocks, bonds, or funds you hold within an IRA. (If nothing else, this makes for simple accounting come tax time.)

Even better, you make contributions to a Traditional IRA with pre-tax dollars . For instance, say you make $100,000. With a marginal tax rate of 25%, you would owe roughly $16,857 a year in taxes (depending on a lot of other assumptions). So you'll take home $83,143.

If both you and your spouse make the maximum allowable annual IRA contributions of $5,500, you'll adjust your taxable income to $89,000 ($100,000 minus two $5,500 contributions). Your tax bill drops to $14,107. You end up taking home $74,893... but you also set aside $11,000. So, instead of $83,143 of net worth, you've got $85,893. That's an extra $2,750...

Another way to look at it: You get $11,000, but it only cost you $8,250. That's an immediate 33% return on your investment , which you then compound for decades.

Do that year after year and that builds an incredible amount of wealth. Plus you're building this wealth inside a tax shelter... which means no taxes.

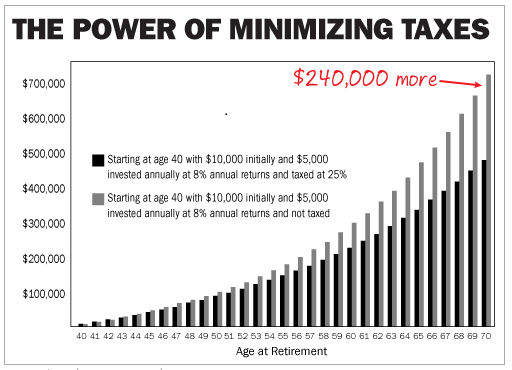

The difference between compounding without paying taxes and paying taxes along the way can be seen in the following chart...

Two people start off with $10,000 each. One put his money in a tax-deferred account. The other did not.

Over 30 years, the tax-deferred account would be worth $720,406. The taxed account would be worth $479,889. That's more than $240,000 extra just by avoiding taxes .

If you don't have an IRA now... let us verify your eligibility and then, if you are eligible, open one immediately.

Here's to your health, wealth, and a great retirement,